The thought of navigating business regulations, contracts, and legal structures keeps countless talented professionals trapped in employee roles. Yet the legal aspects of business ownership aren't designed to be barriers—they're frameworks that, once understood, can actually protect and empower your entrepreneurial journey.

The Psychology of Legal Intimidation

When surveyed, 68% of employees with entrepreneurial aspirations cite "legal complexities" as a primary reason they haven't started their own business. This fear stems from three common misconceptions:

- The belief that you need comprehensive legal knowledge before starting

- The assumption that legal mistakes are both inevitable and catastrophic

- The perception that legal compliance is prohibitively expensive

Pro Tip

Successful entrepreneurs don't know everything about business law—they simply know when and where to find reliable information, and which decisions require professional consultation.

Stage 1: Business Structure Simplified

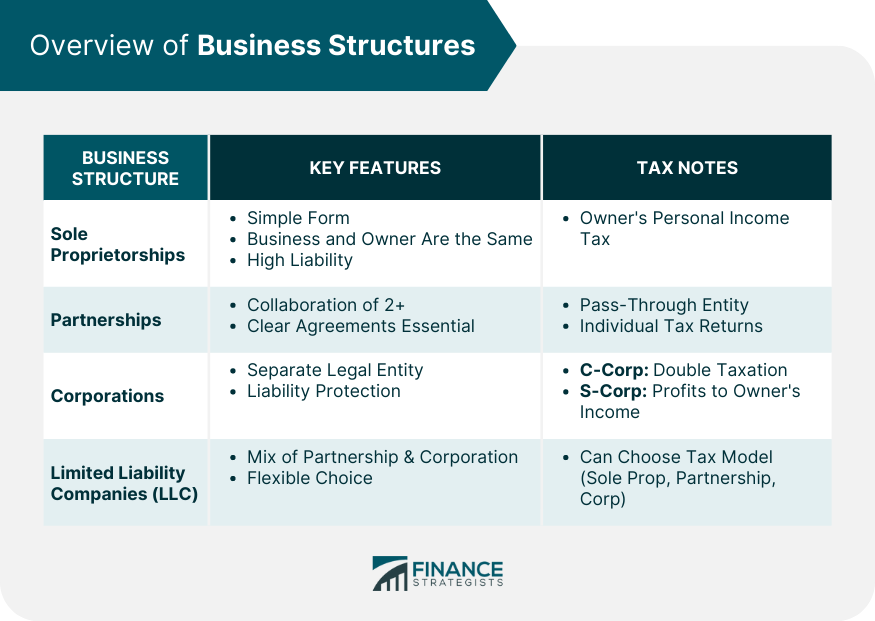

Choosing your business structure is often the first legal decision that overwhelms potential business owners. Let's break down the options without the legalese:

Sole Proprietorship: The Default Option

A sole proprietorship requires minimal paperwork and offers complete control, but provides no separation between personal and business liabilities.

Real-world Example: James started a graphic design business as a sole proprietor with just a local business license and separate business bank account. This structure worked perfectly for his first two years while he built his client base and established proof of concept with minimal startup costs.

Limited Liability Company (LLC): The Popular Middle Ground

An LLC offers personal asset protection while maintaining operational flexibility and simpler taxation than corporations.

Comparison of liability protection, taxation, and complexity across business structures.

Corporation: The Growth Structure

Corporations offer the strongest liability protection and are designed for businesses planning significant growth, outside investment, or eventual sale.

Pro Tip

Your initial business structure isn't permanent. Many successful businesses start as sole proprietorships, transition to LLCs as they grow, and eventually convert to corporations when scaling significantly or seeking investment.

Stage 2: Contracts Without Complexity

Contracts form the foundation of business relationships, yet their perceived complexity deters many potential entrepreneurs. Here's how to approach them with confidence:

The Essential Elements

Every effective contract, regardless of complexity, contains these core elements:

- Clear identification of all parties involved

- Specific description of goods/services being exchanged

- Compensation details and payment terms

- Timeline for delivery or performance

- Conditions for termination or modification

Template-Based Solutions

You don't need to create contracts from scratch. Industry-specific templates provide reliable starting points that can be customized to your needs.

Real-world Example: Elena launched her consulting business using contract templates from a reputable online legal service. She customized key sections to reflect her specific services and payment terms. These templates cost under $100 but have successfully protected her through over $250,000 in client engagements.

When to Seek Professional Review

While many routine contracts can be handled independently, certain situations warrant professional legal review:

- High-value agreements (typically over $10,000)

- Long-term commitments (over one year)

- Contracts with unusual or complex terms

- Agreements with international parties

Stage 3: Compliance Made Manageable

Regulatory compliance often appears as an overwhelming maze of requirements. Here's how to navigate it efficiently:

The Tiered Approach to Compliance

Not all regulations require equal attention at every business stage. Prioritize compliance using this framework:

The compliance pyramid shows which regulations to address at different business stages.

Essential First-Year Compliance

For most new businesses, these fundamental compliance areas deserve immediate attention:

- Business registration and licensing

- Tax ID acquisition and basic tax compliance

- Industry-specific permits (if applicable)

- Basic employment law compliance (if hiring)

Pro Tip

Create a simple compliance calendar that sends automatic reminders for recurring requirements like quarterly tax payments, annual report filings, and license renewals. This transforms compliance from a constant worry into a scheduled task.

Stage 4: Cost-Effective Legal Resources

Legal support doesn't have to break the bank. Modern entrepreneurs have access to tiered legal resources:

Self-Service Legal Tools

For routine matters, numerous affordable resources exist:

- Online legal document platforms

- Industry association resources and templates

- Small Business Administration (SBA) guidance

- Chamber of Commerce workshops and materials

Fractional Legal Services

Between self-service and full representation lies a valuable middle ground:

Real-world Example: Marcus launched his e-commerce business using primarily self-service legal resources. As his business grew, he established a relationship with a business attorney who offers a monthly retainer package. For $300/month, he can ask questions, get document reviews, and receive guidance without the surprise of hourly billing. This arrangement provides peace of mind while keeping legal costs predictable.

Building a Legal Network

Developing relationships with legal professionals before urgent needs arise leads to better outcomes and often more favorable rates.

The Entrepreneur's Legal Mindset

Beyond specific legal knowledge, successful business owners develop a particular mindset toward legal matters:

Preventive Rather Than Reactive

Addressing potential legal issues before they become problems is invariably less expensive and stressful than resolving conflicts after they emerge.

Risk Management vs. Risk Elimination

The goal isn't to eliminate all legal risk—that's impossible in business. Instead, focus on identifying, understanding, and consciously managing risks based on their likelihood and potential impact.

Pro Tip

When evaluating a legal risk, multiply the probability of occurrence by the potential cost of the worst-case outcome. This helps prioritize which risks deserve immediate attention and investment versus those that can be addressed later.

From Employee to Employer: The Legal Transition Plan

Making the leap from employee to business owner is easier with a structured approach to legal matters:

Month 1-2: Foundation

- Research and select business structure

- Register business name and entity

- Obtain necessary tax IDs

- Set up separate business banking

Month 3-4: Client/Customer Framework

- Develop core service/product agreements

- Create client onboarding process

- Establish payment terms and policies

Month 5-6: Growth Protection

- Implement basic intellectual property protection

- Secure appropriate business insurance

- Develop privacy policy and terms of service

Conclusion: Legal Confidence as a Competitive Advantage

Understanding the legal aspects of business ownership isn't just about avoiding problems—it's about creating a foundation for confident growth. When you're no longer paralyzed by legal uncertainty, you can make decisions more quickly, pursue opportunities more boldly, and ultimately build a more successful business.

The entrepreneurs who thrive aren't necessarily those with the most legal knowledge, but those who have developed systems to address legal needs appropriately at each business stage. By following the frameworks outlined in this guide, you can transform legal considerations from a barrier to a competitive advantage in your entrepreneurial journey.