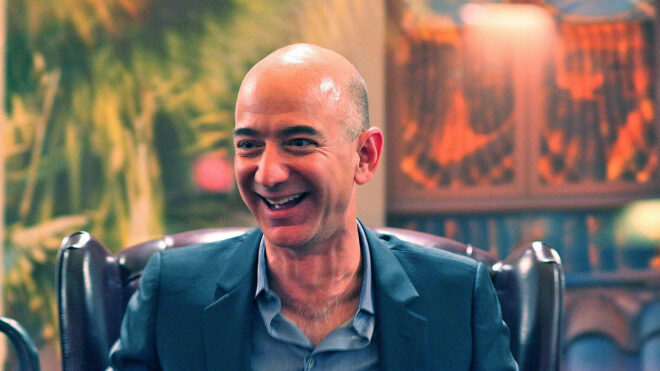

Jeff Bezos makes $81,000 per year. Elon Musk takes no salary. Warren Buffett pays himself $100,000 annually. Yet they're among the richest people alive. If you think this is a contradiction, you've fallen for the biggest money lie ever told.

The Lie That Keeps You Poor

Here's what nobody tells you: Rich people don't have money. They have assets that generate money.

This isn't semantic wordplay. It's the fundamental difference between wealth and income that keeps 99% of people trapped in the middle class forever.

The Wealth Reality Check

When you ask "How much money does Bezos have?" you're asking the wrong question. Bezos doesn't have $150 billion in cash. He owns Amazon stock that the market values at $150 billion. The "money" exists only when someone agrees to buy those shares.

Why Your Money Strategy Is Backwards

Most people work FOR money. They trade time for dollars, save those dollars, and hope to accumulate enough to retire. This is the poverty mindset disguised as financial responsibility.

Wealthy people make money work FOR them. They don't collect dollars—they create systems that create dollars.

The Asset vs. Income Trap

Consider two executives:

- Executive A: Earns $500K salary, saves $100K annually, has $2M in savings after 20 years

- Executive B: Earns $300K salary, invests in rental properties and index funds, owns $5M in assets after 20 years

Executive A has more "money." Executive B has more wealth. Guess who retires comfortably?

Real Example: A McDonald's franchise owner might take home less cash monthly than their store manager. But the owner builds equity in a business asset. The manager just gets paychecks. After 10 years, the owner can sell for millions. The manager has... a resume.

The Money Generation Machine

Here's what rich people understand that you don't: money is infinite, but time isn't. So they build machines that generate money without consuming their time.

These "machines" include:

- Businesses: Systems that generate profit without your daily involvement

- Real Estate: Properties that appreciate and generate rental income

- Investments: Stocks, bonds, and funds that compound over time

- Intellectual Property: Patents, royalties, and licensing deals

- Digital Assets: Websites, apps, and online businesses that scale

The Compound Effect Nobody Explains

When you save $1,000, you have $1,000. When you invest $1,000 in an asset that returns 10% annually, you have $1,100 after year one, $1,210 after year two, and $2,594 after 10 years—without adding another dollar.

But here's the kicker: that same $1,000 invested in a business that grows 30% annually becomes $13,786 in 10 years. The difference between saving and asset-building isn't incremental—it's exponential.

The exponential difference between saving money and building wealth through assets becomes undeniable over time.

Why This Misconception Exists

The "work hard, save money" narrative serves the system perfectly. It creates a reliable workforce of people who trade their most valuable asset (time) for the least valuable reward (linear income).

Meanwhile, business owners and investors capture the exponential returns from other people's time and effort.

The Mindset Shift

Stop asking: "How can I make more money?" Start asking: "How can I build something that makes money while I sleep?" This single question separates wealth builders from wage earners.

The Business Leader's Advantage

As an executive or entrepreneur, you're uniquely positioned to understand this principle. Every business decision should pass the asset test:

- Does this create lasting value beyond the immediate transaction?

- Will this generate returns without my constant involvement?

- Am I building equity or just generating cash flow?

Practical Applications

In your career: Negotiate for equity, stock options, or profit-sharing instead of just salary increases.

In your business: Build systems and processes that can operate without you. Create intellectual property. Develop recurring revenue streams.

In your investments: Focus on assets that appreciate and generate income. Avoid "investments" that only provide returns when you sell.

Case Study: Two software executives start companies. Executive A builds a consulting firm—high revenue, but income stops when work stops. Executive B builds a SaaS platform—lower initial revenue, but recurring subscriptions create lasting asset value. After 5 years, Executive A has a job. Executive B has a sellable business worth millions.

The Wealth Acceleration Formula

Here's the formula wealthy people use:

Income → Assets → More Income → More Assets → Exponential Wealth

Most people stop at step one. They earn income and spend it or save it. Wealthy people immediately convert income into assets that generate more income, creating a compounding cycle.

Starting Your Asset Portfolio

You don't need millions to start. You need the right mindset:

- Audit your spending: Every purchase is either an asset (appreciates/generates income) or an expense (depreciates/costs money)

- Redirect cash flow: Instead of upgrading your lifestyle with raises, invest the difference

- Think in systems: Look for opportunities to create recurring value

- Leverage other people's time: Hire, delegate, and systematize

The Time Arbitrage Secret

The ultimate wealth secret is time arbitrage. While you're sleeping, your assets are working. While you're on vacation, your investments are compounding. While you're focused on new projects, your existing assets generate passive income.

This is why Bezos can "make" $13 billion in a single day when Amazon stock rises, or "lose" $7 billion when it falls. He's not making or losing money—the market is revaluing his assets.

The Wealth Test

Ask yourself: If I stopped working today, how long could I maintain my lifestyle? If the answer is less than 10 years, you're still trapped in the income game. Wealthy people could stop working and maintain their lifestyle indefinitely because their assets generate more than they spend.

Breaking Free From the Money Illusion

The biggest money misconception isn't about budgeting, saving, or even investing. It's about fundamentally misunderstanding what money is and how wealth actually works.

Money is a tool for acquiring assets. Assets are tools for generating wealth. Wealth is freedom from the time-for-money trade.

Once you understand this hierarchy, every financial decision becomes clear. You stop chasing money and start building wealth-generating systems.

Your Next Steps

Starting today:

- Reframe your goals: Instead of "I want to make $X," think "I want to build assets worth $X"

- Evaluate opportunities: Does this create an asset or just income?

- Invest in education: Learn about business, real estate, and investing

- Start small: Buy your first income-generating asset, even if it's just index funds

- Think long-term: Wealth building is a marathon, not a sprint

The Million-Dollar Realization

Here's the truth that changes everything: You'll never get rich working for money. You can only get rich by making money work for you.

This isn't about getting lucky or having special advantages. It's about understanding the fundamental difference between income and wealth—and acting on that knowledge.

The middle class trades time for money. The wealthy trade money for time. Which game are you playing?

Final Thought: Every dollar you spend on consumption is a dollar that can't work for you. Every dollar you invest in assets is a dollar that can multiply and generate more dollars. The choice you make with each dollar determines whether you build wealth or stay trapped in the income cycle.

The question isn't whether you can afford to start building assets. The question is whether you can afford not to.