There's a pivotal moment in business when something that was once freely given transforms into something people willingly pay for. Understanding this transformation isn't about luck or marketing prowess—it's about recognizing the conditions that allow value to become currency.

The Mechanics of Value Transformation

A gesture becomes a service. A habit becomes a role. A tool becomes a product. And suddenly, value becomes money.

This transformation doesn't happen by accident. It's not about being lucky, loud, or more deserving than others. It's about understanding the underlying conditions that facilitate this change.

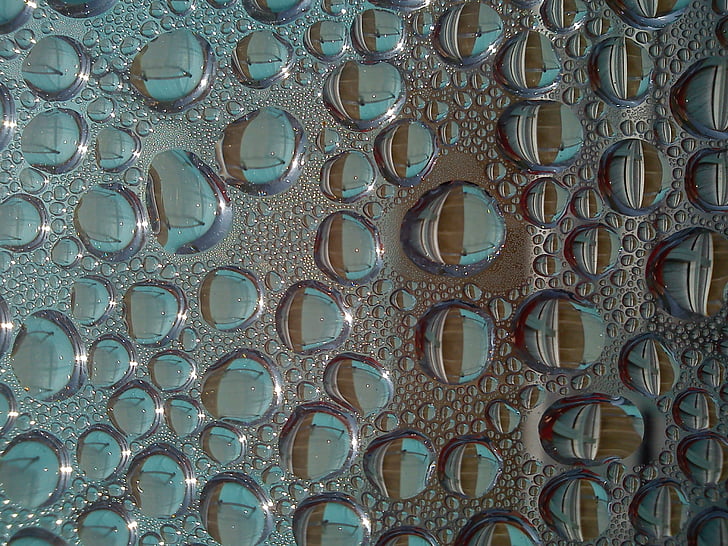

The journey from unstructured value to monetizable assets follows predictable state changes, much like water transforming from vapor to solid.

A Working Analogy: State Changes

Think of water. It exists in multiple forms: vapor, liquid, solid. Each form is the same substance—but responds differently to the environment.

Value works the same way.

You can't freeze steam. You can't drink ice. To work with it—to store it, trade it, rely on it—the state has to match the need.

So if you're trying to understand how your work, your skill, your product becomes monetizable, you're not trying to invent value. You're trying to recognize what state it's in—and what's required for it to change form.

1. Vapor: Informal, Unpackaged Usefulness

This is where most value starts.

You help, you build, you explain—naturally. Others benefit. They might admire it, even rely on it. But there's no structure around it. No offer. No price. No delivery path.

It's valuable—but not transferable. In this state, money can't stick to it. Not because it's unworthy—but because there's nothing to grab.

Pro Tip

Identify your "vapor state" value by asking: What do people thank you for? What advice do they seek from you repeatedly? What problems do you solve naturally that others struggle with? These are your potential monetization opportunities.

2. Condensation: Taking Shape

This is the moment when value becomes visible.

You give it a form:

- A service with a name

- A product with steps

- A role with expectations

Now it can be explained. Framed. Described in ways others can understand.

It's still adaptable—like liquid—but it flows toward purpose. People begin to see it for what it is, not just how it feels.

At this point, value becomes addressable.

3. Solidification: Becoming Exchangeable

Here, the value is defined.

It has a structure. A cost. A way to say yes. A clear benefit.

The work hasn't changed. But the relationship to it has.

This is where money can flow—not because the value is new, but because it's now prepared.

It can be trusted. Counted. Repeated. And it holds.

Case Study: From Advice to Industry

Consider how financial advising evolved: First, it was informal guidance given by those with knowledge (vapor). Then it became a recognized service with methodologies and frameworks (liquid). Finally, it solidified into a regulated profession with certifications, fee structures, and clear deliverables. The value didn't change—the structure around it did.

Today, we see the same pattern with AI implementation services. What began as casual tech advice is rapidly solidifying into structured service offerings with defined methodologies and measurable outcomes.

4. Conditions for Conversion

Even solid things don't convert automatically. For money to move, the environment must also be ready.

This includes:

- Relevance (the need is real)

- Timing (the buyer is ready)

- Trust (they believe it will deliver)

- Accessibility (they can engage with it easily)

You can have the right offer in the wrong room. Or the right audience, but the wrong language.

When form and context align—even briefly—the conversion happens. And the value crosses over into money.

Pro Tip

Test your market readiness by creating a minimal version of your offering and presenting it to a small segment of your target audience. Their response will tell you whether you've achieved the right state and conditions for monetization.

Why This Matters for Business Leaders

Most businesses don't fail at creating value. They get stuck in the wrong state—or they offer it in the wrong conditions.

Understanding this process helps you breathe. You stop blaming yourself. You stop guessing.

And you start working with the right question:

"What's the next form this value needs to take to become shareable, useful, trusted—and paid for?"

That's not chasing trends. That's learning how energy moves in the marketplace.

Practical Applications in Today's Business Environment

In our digital economy, state changes happen faster than ever. AI tools that were experimental six months ago are now subscription services. Knowledge that was specialized is now packaged into online courses.

The businesses that thrive understand this acceleration and work with it—not by rushing, but by recognizing which state their value is in and what the next transformation requires.

For established businesses, this might mean:

- Repackaging existing expertise into new formats

- Creating structured methodologies around what was once ad-hoc service

- Building trust mechanisms that allow value to solidify in the customer's mind

For startups, it often means:

- Moving quickly from vapor (ideas) to liquid (prototypes)

- Testing solidification through pilot programs

- Creating environmental conditions where early adopters can experience the value directly

In Closing

The transformation from value to currency is not a trick. It's a transition—real, observable, and repeatable.

If you've ever wondered why something brilliant doesn't sell, or why something ordinary does... this is likely why.

Money flows when value is:

- Shaped into recognizable forms

- Understood by those who need it

- Trusted to deliver what it promises

- Invited at the right time and place

That's not just comforting—it's actionable intelligence for your business strategy.

And you're closer than you think to your next value transformation.