What if you discovered you've been an investor your entire life? Not just in financial markets, but in every decision you've made about where to direct your attention, energy, and belief?

Investment, at its essence, isn't about stock portfolios or real estate holdings. It's about the deliberate allocation of valuable resources with the expectation of future returns. By this definition, we are all investors—constantly making choices about where to place our most precious assets.

The Investor Within

Consider your day so far. Perhaps you invested time in a conversation that strengthened a relationship. Maybe you invested energy in solving a problem that will save future headaches. You might have invested attention in learning something new, or belief in a project that matters to you.

These aren't metaphorical investments—they are literal allocations of finite resources with expected returns. The parent reading to their child isn't just "spending time"; they're investing in cognitive development and emotional connection. The professional developing a new skill isn't just "working hard"; they're investing in future capabilities and opportunities.

Recognizing yourself as an investor changes everything. It transforms routine decisions into strategic allocations. It elevates mundane choices into meaningful investments. Most importantly, it places you in the driver's seat of value creation in your own life.

Every day presents countless investment opportunities—moments where your choices about where to direct your resources shape your future returns.

The Hallmarks of a Good Investment

What separates a good investment from a poor one? Whether we're considering financial assets or life choices, certain variables consistently determine investment quality:

Asymmetric Returns

The finest investments offer disproportionate returns relative to what's invested. They follow the Pareto principle—a small input generating outsized output. The hour spent in deep conversation with a mentor might alter your career trajectory. The afternoon dedicated to resolving a recurring problem might save hundreds of future hours.

Look for these asymmetric opportunities in your daily choices. Where might a small allocation of resources today create exponential value tomorrow? These are the investment opportunities most often overlooked yet most worth seizing.

Pro Tip

Before making any significant investment of time or energy, ask yourself: "Is this likely to generate returns that are multiples of what I'm putting in?" The best investments often create value that far exceeds the initial input.

Compounding Potential

Einstein reportedly called compound interest "the eighth wonder of the world," and this principle extends far beyond financial investments. The most powerful investments create returns that themselves become assets generating further returns.

When you invest in foundational knowledge, each new insight builds upon previous understanding. When you invest in key relationships, the trust and goodwill accumulated opens doors to new opportunities. When you invest in systems and habits, the efficiency gains free up resources for additional investments.

The truly sophisticated investor looks beyond immediate returns to consider how those returns might compound over time. They ask not just "What will this generate?" but "What will this enable?"

Alignment with Core Values

A good investment resonates with who you are and what matters most to you. It feels right not just analytically but intuitively. This alignment creates a powerful synergy—the investment generates not only external returns but internal satisfaction.

When your investments align with your values, you bring your full resources to bear. You persist through challenges. You notice opportunities others miss. You experience the dual return of both outcome and process satisfaction.

This alignment isn't a luxury—it's a strategic advantage that enhances every aspect of the investment process.

Real-world example: Patagonia founder Yvon Chouinard built a billion-dollar company by making investment decisions aligned with his environmental values. Rather than compromising these values for short-term gains, he consistently invested in sustainable practices, quality products, and environmental advocacy. The result wasn't just financial success but the creation of a company that could ultimately be given away to fight climate change—perhaps the ultimate return on his value-aligned investments.

The Returns That Matter

What makes an investment truly "good" isn't just the ratio of output to input—it's the nature of the returns themselves. The wisest investors seek returns that genuinely enhance life quality:

Expanded Freedom

Perhaps the most valuable return on any investment is expanded freedom—greater ability to allocate your resources according to your own priorities rather than external necessities.

This freedom takes many forms: financial independence that liberates you from unwanted work, systems that free you from routine tasks, knowledge that gives you more options, relationships that provide support when needed.

The best investments don't just generate more resources—they expand your freedom to use those resources in meaningful ways.

Enhanced Capacity

Good investments often return enhanced capacity—they make you more capable, more resilient, more effective. They expand what you can do and who you can be.

This capacity might come through new skills, deeper understanding, stronger relationships, improved health, or greater emotional resilience. Whatever the specific form, these investments make you more than you were before—they are literally capacity-building.

Unlike material returns that can be lost or depleted, enhanced capacity tends to be durable and often appreciates rather than depreciates over time.

Deeper Connection

Some of the highest-returning investments generate deeper connection—to others, to meaningful work, to yourself, to something larger than yourself.

These connection returns address our fundamental human need for belonging and meaning. They create contexts in which other achievements become more satisfying and challenges become more manageable.

The investor who recognizes the value of connection returns often makes different choices than one focused solely on material or status returns—and typically ends up with a richer life as a result.

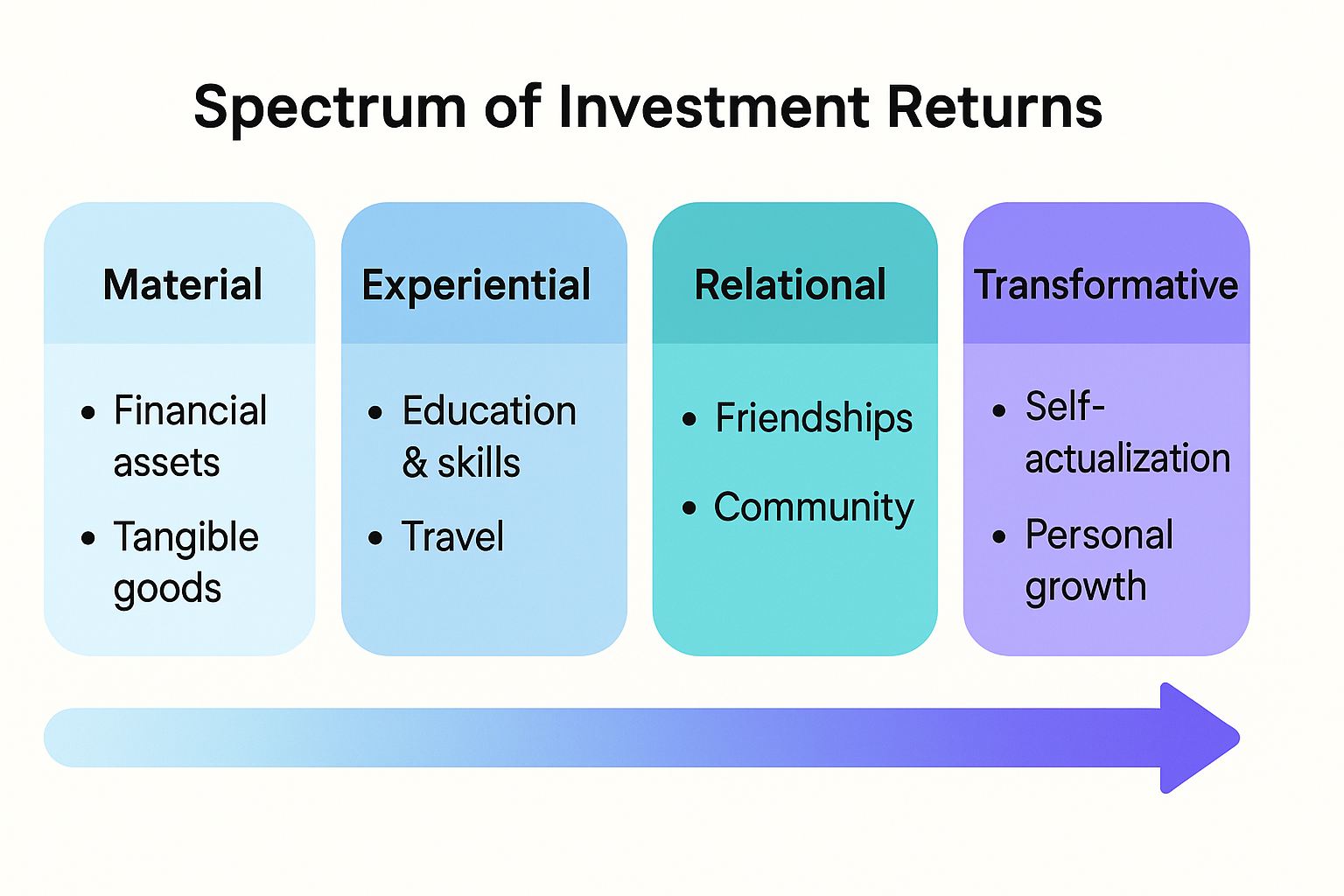

The spectrum of investment returns extends far beyond the material to include experiential, relational, and transformative dimensions that often create the greatest life value.

The Portfolio Perspective

No single investment, no matter how good, creates a fulfilled life. The art of good investment requires a portfolio perspective—a thoughtful balance across different types of investments and returns.

This perspective recognizes the interconnected nature of different life domains. Financial investments that destroy health are ultimately poor investments. Career investments that damage key relationships may not be worth their professional returns. Time investments that conflict with core values create internal friction that diminishes their effectiveness.

The sophisticated investor regularly steps back to assess their full portfolio across all resource types and all life domains. They look for imbalances, conflicts, and synergies. They make adjustments not just within categories but across them.

Pro Tip

Schedule a quarterly "life portfolio review" where you assess how you're allocating all your resources—time, energy, attention, money, belief—across different life domains. Look for imbalances, diminishing returns, and untapped opportunities. Make deliberate adjustments based on what you discover.

The Investor's Mindset

Beyond specific investment choices, what truly separates good investors from poor ones is their mindset—the lens through which they view decisions and opportunities.

Long-Term Orientation

Good investors maintain a long-term perspective. They're willing to accept short-term costs for long-term gains. They understand that the most valuable returns often take time to materialize.

This orientation doesn't mean ignoring the present—it means including the future in present calculations. It means considering not just immediate impacts but downstream effects. It means recognizing that some of the best investments look like losses in the short term but create tremendous value over time.

Opportunity Awareness

Good investors develop a heightened awareness of investment opportunities that others miss. They recognize that these opportunities are everywhere—in conversations, in problems, in changes, in questions.

This awareness isn't about constant calculation or commodifying every interaction. It's about recognizing the potential for value creation in everyday moments. It's about approaching life with curiosity about where small inputs might generate significant returns.

Experimental Approach

Good investors embrace an experimental mindset. They recognize that uncertainty is inevitable and perfect information impossible. Rather than letting this paralyze them, they make thoughtful bets, observe the results, and adjust accordingly.

This approach balances analysis with action. It combines careful consideration with a willingness to try, fail, learn, and try again. It acknowledges that some of the best investments aren't obvious in advance but reveal themselves through engagement and iteration.

Real-world example: Jeff Bezos attributes much of Amazon's success to this experimental investment approach. "If you double the number of experiments you do per year, you're going to double your inventiveness," he explains. This philosophy led Amazon to try many initiatives that failed (like the Fire Phone) but also to discover unexpected successes (like AWS) that transformed the company and the broader technology landscape.

Becoming a Better Investor

How do we improve our investment decisions across all domains of life? A few principles stand out:

Cultivate Self-Knowledge

Good investment begins with understanding yourself—your values, strengths, patterns, and blind spots. This self-knowledge helps you identify investments that genuinely fit you rather than generic "good investments" that might be poor matches for your specific situation.

Regular reflection on past investments—what worked, what didn't, and why—builds this self-knowledge over time. It creates an increasingly refined internal compass for future decisions.

Expand Your Conception of Returns

Many poor investment decisions stem from a narrow conception of returns—focusing solely on financial metrics, status markers, or other limited measures of success.

Expanding your awareness of different types of returns—peace of mind, time freedom, energy enhancement, relationship depth, personal growth, meaningful impact—creates a richer decision-making framework. It helps you recognize value that might otherwise be invisible.

Build Investment Literacy

Just as financial investors study markets and instruments, life investors can build literacy about different types of investments and their typical patterns of return.

This literacy comes through reading widely, conversing deeply, experimenting regularly, and reflecting consistently. It creates mental models and pattern recognition that improve decision quality across domains.

The Ultimate Investment

Perhaps the most important investment we make is in our own investment capacity—our ability to make wise choices about resource allocation across all domains of life.

This meta-investment compounds across every other decision. It improves not just individual choices but the entire system by which choices are made. It transforms us from reactive resource allocators to proactive value creators.

And unlike many investments that depreciate over time, this investment in wisdom and discernment typically appreciates with age and experience. It represents perhaps the ultimate example of compounding returns.

Conclusion: The Good Investor Within

You are already an investor. Every day, you make dozens of decisions about where to allocate your precious and finite resources. The question isn't whether you'll invest, but how wisely you'll do so.

The good investor isn't defined by the size of their financial portfolio but by the wisdom of their resource allocations across all domains of life. They recognize investment opportunities others miss. They make choices with awareness of both immediate impacts and long-term implications. They seek returns that genuinely enhance life quality rather than merely accumulate conventional markers of success.

By embracing your identity as an investor and refining your investment approach, you take a powerful step toward creating a life rich in the returns that matter most to you. You move from passive consumer to active creator, from reactive responder to strategic allocator.

The art of good investment isn't about complex financial instruments or exclusive opportunities. It's about bringing consciousness and intention to the choices we all make every day. It's about recognizing the extraordinary power we each have to create value through wise resource allocation.

In this broader and more meaningful sense, becoming a good investor may be one of the most important journeys we can undertake—and one that's available to each of us, starting today.