A well-crafted business plan is more than just a document—it's a roadmap to success, a tool for securing funding, and a framework for making critical decisions. Yet many entrepreneurs struggle to create plans that actually drive results.

In this comprehensive guide, we'll walk through the process of creating a business plan that works in the real world, not just on paper. You'll learn practical strategies, see real-world examples, and get templates you can use right away.

Why Most Business Plans Fail

Before diving into how to create an effective business plan, let's understand why so many fall short:

- Too theoretical - Filled with assumptions that aren't grounded in market reality

- Too rigid - Unable to adapt to changing market conditions

- Too detailed - So complex they're never actually used for decision-making

- Too vague - Lacking specific, actionable strategies and metrics

- Too isolated - Created once and then filed away, never to be revisited

The most effective business plans avoid these pitfalls by focusing on practicality, adaptability, and ongoing relevance to your business operations.

Pro Tip: The Living Document Approach

Think of your business plan as a living document that evolves with your business. Schedule quarterly reviews to assess what's working, what's not, and how market conditions have changed. Update your plan accordingly to keep it relevant and useful.

The Modern Business Plan Framework

Today's most effective business plans follow a modular framework that balances comprehensiveness with usability:

1. Executive Summary (2 pages max)

Despite appearing first, write this section last. It should concisely capture:

- Your business concept and value proposition

- Target market and opportunity size

- Business model and revenue streams

- Competitive advantages

- Team highlights

- Financial summary and funding needs (if applicable)

The executive summary should stand alone as a mini-version of your full plan, allowing busy readers to grasp your business concept quickly.

2. Company Overview (1-2 pages)

This section establishes your company's foundation:

- Mission and vision statements

- Company history and current status

- Legal structure and ownership

- Location and facilities

- Long-term goals and milestones

Mission Statement Examples

Weak: "To be the best software company in the industry."

Strong: "To empower small businesses to compete with enterprise companies by providing affordable, enterprise-grade marketing automation tools that increase customer engagement while reducing manual workload."

The stronger version clearly communicates who the company serves, what it provides, and the specific value it delivers.

3. Market Analysis (3-4 pages)

This critical section demonstrates your understanding of the market landscape:

- Industry overview - Size, growth trends, and key drivers

- Target market segmentation - Detailed customer profiles

- Market needs and pain points - Specific problems you're solving

- Market size calculation - TAM, SAM, and SOM analysis

- Competitive analysis - Direct and indirect competitors

- Regulatory considerations - Legal factors affecting your business

Support your analysis with credible data sources and primary research whenever possible.

Comprehensive market analysis framework for business planning

4. Products and Services (2-3 pages)

Detail what you're selling and why it matters:

- Product/service descriptions - Features and benefits

- Value proposition - Why customers will choose your offering

- Development status - Current stage and roadmap

- Intellectual property - Patents, trademarks, or proprietary technology

- Pricing strategy - How you'll price your offerings

Focus on customer benefits rather than technical specifications, and clearly articulate what makes your offering unique.

5. Marketing and Sales Strategy (3-4 pages)

Outline how you'll reach and convert customers:

- Positioning strategy - How you'll be perceived in the market

- Customer acquisition channels - How you'll reach prospects

- Marketing tactics and budget - Specific activities and costs

- Sales process and cycle - How deals close and typical timeframes

- Customer retention strategies - How you'll maintain relationships

- Key metrics - How you'll measure marketing effectiveness

Pro Tip: The Channel Matrix

Create a matrix that evaluates each marketing channel based on cost, reach, conversion rate, and time to results. This helps prioritize where to allocate resources for maximum impact, especially with limited budgets.

6. Operations Plan (2-3 pages)

Describe how your business will function day-to-day:

- Production process or service delivery

- Facilities and equipment requirements

- Supply chain and vendor relationships

- Quality control procedures

- Customer service approach

- Key operational metrics and benchmarks

This section should demonstrate that you've thought through the practical aspects of running your business efficiently.

7. Management and Organization (1-2 pages)

Introduce the team that will execute your vision:

- Organizational structure and reporting relationships

- Management team bios highlighting relevant experience

- Board of directors/advisors and their contributions

- Hiring plan for key positions

- Compensation strategy including incentive structures

Investors often say they invest in people first and ideas second, so this section is particularly important if you're seeking funding.

8. Financial Plan (4-5 pages plus appendices)

Provide a realistic picture of your financial trajectory:

- Startup costs and capital requirements

- Revenue projections with underlying assumptions

- Expense forecasts by category

- Cash flow projections (monthly for year 1, quarterly for years 2-3)

- Break-even analysis showing when profitability occurs

- Balance sheet and income statement projections

- Funding requirements and use of funds

Sample financial projection template for startups

Include both optimistic and conservative scenarios, and clearly document all assumptions. Detailed spreadsheets should be included in the appendix.

9. Risk Analysis (1-2 pages)

Demonstrate foresight by addressing potential challenges:

- Market risks - Competitive threats, changing customer preferences

- Operational risks - Supply chain disruptions, quality issues

- Financial risks - Cash flow gaps, currency fluctuations

- Strategic risks - Technology shifts, regulatory changes

- Mitigation strategies for each identified risk

Addressing risks proactively demonstrates maturity and preparedness to stakeholders.

Risk Assessment Matrix

Create a simple matrix that evaluates each risk based on:

- Probability - How likely is this to occur? (Low/Medium/High)

- Impact - How severe would the consequences be? (Low/Medium/High)

- Mitigation - What specific steps will you take to prevent or address this risk?

- Contingency - What's your plan if the risk materializes despite prevention?

This structured approach shows stakeholders you've thought through potential challenges systematically.

10. Implementation Plan (2-3 pages)

Bridge the gap between planning and execution:

- Key milestones with specific dates

- Critical path activities that must happen in sequence

- Resource allocation for major initiatives

- Responsibilities and accountability

- Progress tracking methods and tools

This section transforms your plan from a static document into an actionable roadmap.

11. Appendices (as needed)

Include supporting materials that add depth without cluttering the main document:

- Detailed financial spreadsheets

- Market research data and sources

- Product specifications or technical details

- Legal documents (patents, contracts, etc.)

- Resumes of key team members

- Customer testimonials or case studies

Tailoring Your Business Plan for Different Audiences

One size doesn't fit all when it comes to business plans. Consider creating different versions for specific purposes:

Internal Operating Plan

For your team's use in day-to-day decision making:

- More detailed operational procedures

- Specific KPIs and accountability measures

- Tactical action items with owners and deadlines

- Regular review and update schedule

Investor Pitch Plan

For securing funding:

- Stronger emphasis on market opportunity and growth potential

- Clear articulation of competitive advantages and barriers to entry

- Detailed use of funds and expected return on investment

- Team credentials that inspire investor confidence

Bank Loan Plan

For debt financing:

- Conservative financial projections with detailed assumptions

- Strong emphasis on cash flow and ability to service debt

- Collateral and personal guarantees

- Industry comparables and benchmarks

Pro Tip: The Modular Approach

Build your business plan in modular sections that can be easily reconfigured for different audiences. Maintain a comprehensive "master plan" with all details, then create tailored versions by selecting and emphasizing relevant sections for specific purposes.

Business Plan Development Process

Follow this systematic approach to create a plan that's both comprehensive and practical:

Phase 1: Research and Discovery (2-4 weeks)

- Conduct market research (both primary and secondary)

- Analyze competitors and their strategies

- Interview potential customers about needs and pain points

- Consult industry experts and advisors

- Gather financial benchmarks for similar businesses

Phase 2: Strategy Development (1-2 weeks)

- Define your value proposition and competitive positioning

- Develop your business model and revenue streams

- Outline marketing and sales approaches

- Create operational frameworks

- Establish key milestones and success metrics

Phase 3: Financial Modeling (1-2 weeks)

- Build bottom-up revenue projections

- Develop detailed expense forecasts

- Create cash flow projections

- Perform sensitivity analysis on key variables

- Determine funding requirements

Phase 4: Documentation and Refinement (1-2 weeks)

- Draft each section of the business plan

- Create supporting visuals and graphics

- Review for consistency and clarity

- Get feedback from advisors and stakeholders

- Refine based on input

Phase 5: Implementation Planning (1 week)

- Break down strategic objectives into tactical actions

- Assign responsibilities and deadlines

- Establish review and update processes

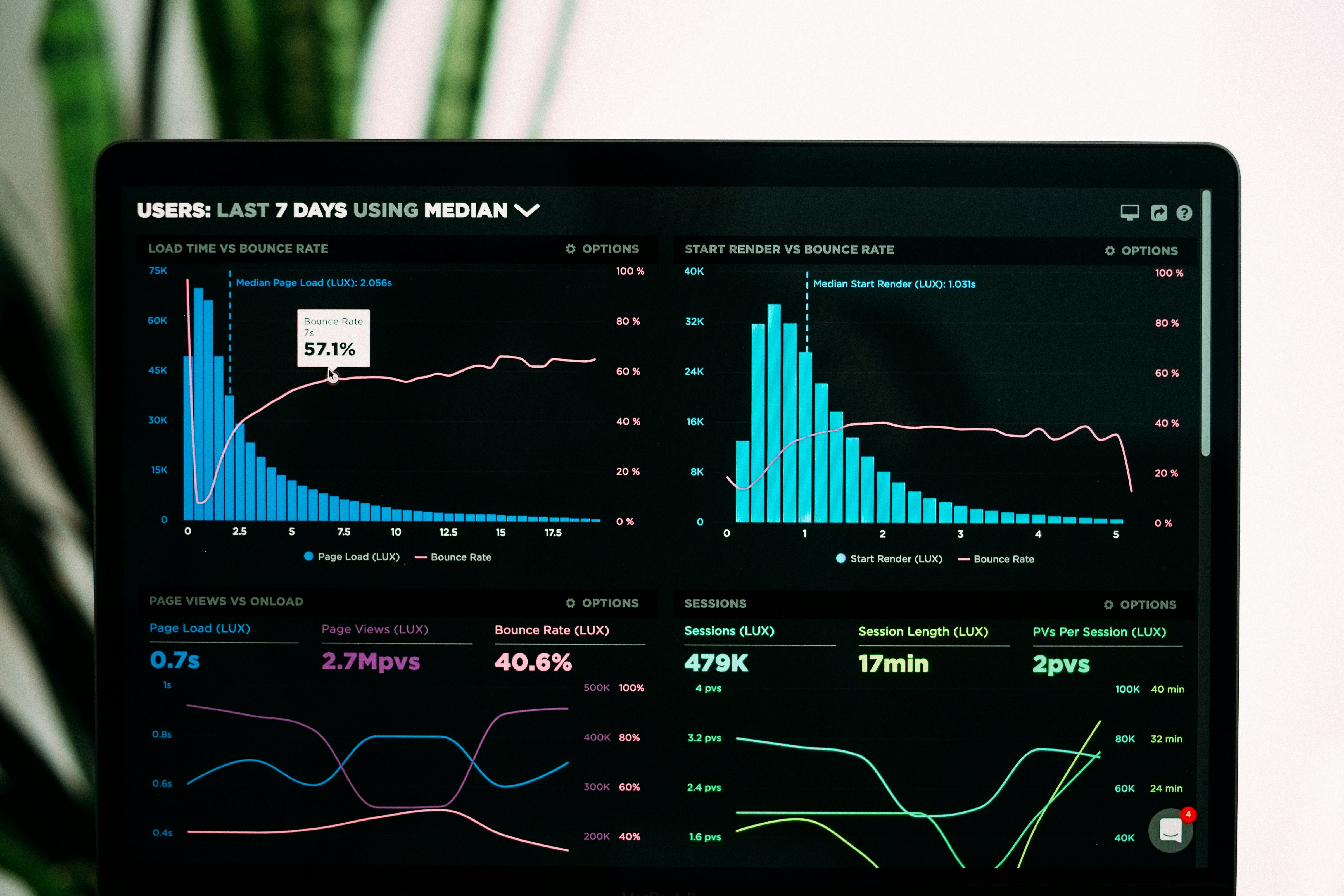

- Create dashboards for tracking key metrics

- Schedule regular plan review sessions

The five phases of effective business plan development

Common Business Plan Mistakes to Avoid

Watch out for these pitfalls that can undermine your planning efforts:

Strategic Mistakes

- Overestimating market size or growth potential

- Underestimating competition or barriers to entry

- Failing to identify a clear target customer and value proposition

- Assuming product superiority without customer validation

- Neglecting distribution challenges and customer acquisition costs

Financial Mistakes

- Unrealistic revenue projections without clear drivers

- Underestimating expenses, especially hidden costs

- Ignoring cash flow timing and working capital needs

- Failing to account for seasonality or market cycles

- Overlooking tax implications and compliance costs

Operational Mistakes

- Insufficient detail on execution strategies

- Unrealistic timelines for key milestones

- Overlooking resource constraints and dependencies

- Failing to identify critical success factors and risks

- Not establishing clear metrics for measuring progress

Reality Check Questions

Before finalizing your business plan, ask these critical questions:

- Have we validated our key assumptions with real market data?

- Would an industry expert find our projections credible?

- Have we identified and addressed the top 3-5 risks that could derail our plan?

- Is our financial model built on specific, defensible assumptions?

- Does our implementation plan include clear accountability and milestones?

If you can't answer "yes" to all of these questions, your plan likely needs further refinement.

Business Plan Tools and Resources

Leverage these tools to streamline your planning process:

Business Plan Software

- LivePlan - Comprehensive planning tool with financial forecasting

- Bizplan - Modern, step-by-step business planning platform

- Enloop - Automated writing and financial projections

- PlanGuru - Advanced financial forecasting and scenarios

Financial Modeling Tools

- Excel/Google Sheets - Customizable templates for financial projections

- Finmark - Financial planning specifically for startups

- Foresight - Professional-grade financial models

- Causal - Visual financial modeling with scenarios

Market Research Resources

- IBISWorld - Industry reports and market analysis

- Statista - Statistics and market data

- Google Trends - Search interest and market trends

- SurveyMonkey - Customer survey tools

- Census Bureau - Demographic and economic data

Bringing Your Business Plan to Life

The true value of a business plan lies not in its creation but in its implementation. Here's how to ensure your plan drives real business results:

Create an Implementation Dashboard

Develop a visual dashboard that tracks:

- Key performance indicators (KPIs) tied to plan objectives

- Milestone progress and deadlines

- Resource allocation and utilization

- Variances between projected and actual results

Establish Regular Review Cadence

Schedule structured review sessions:

- Weekly - Tactical implementation and short-term adjustments

- Monthly - Performance against key metrics and resource allocation

- Quarterly - Strategic progress and plan adjustments

- Annually - Comprehensive plan review and major updates

Create Feedback Loops

Establish mechanisms to capture insights that inform plan updates:

- Customer feedback channels

- Team input on implementation challenges

- Market and competitive intelligence

- Financial performance analysis

Pro Tip: The One-Page Plan Summary

Create a one-page visual summary of your business plan that highlights key goals, strategies, and metrics. Display this prominently in your workspace and share it with your team to keep everyone aligned on priorities and progress.

Conclusion: From Planning to Action

A business plan that works isn't measured by its length or how impressive it looks on paper—it's measured by how effectively it guides your business decisions and drives results.

By following the framework outlined in this guide, you'll create a plan that balances comprehensive strategy with practical implementation. Remember that the most valuable business plans are living documents that evolve with your business, providing ongoing guidance while adapting to changing market conditions.

The ultimate goal isn't to create a perfect plan, but to build a successful business. Your plan is simply a tool to help you get there—so use it actively, update it regularly, and let it guide you toward your business goals.