Market research isn't just an academic exercise—it's the compass that guides every successful business decision. In today's data-rich environment, companies that leverage market insights consistently outperform those that rely on intuition alone.

Whether you're launching a startup, developing a new product, or expanding into new markets, quality research provides the foundation for confident decision-making. This guide will walk you through practical approaches to market research that deliver actionable insights without requiring enterprise-level resources.

Why Market Research Matters More Than Ever

In an era of rapid market shifts and evolving consumer preferences, businesses can't afford to make assumptions about their target audience. Consider these statistics:

- 42% of startups fail because they create products with no market need

- Companies that conduct systematic market research grow 2-3x faster than competitors

- Every $1 invested in research typically returns $10-20 in revenue optimization

Effective market research reduces uncertainty, identifies opportunities, and helps allocate resources where they'll generate the greatest return.

The continuous cycle of market research, insight generation, and business adaptation

The Four Pillars of Effective Market Research

While research methodologies vary widely, the most effective approaches incorporate these four essential elements:

1. Customer Research

Understanding your target customers—their needs, preferences, behaviors, and pain points—forms the cornerstone of market research. Effective customer research combines:

- Demographic analysis: Who are your customers in terms of age, location, income, education, etc.?

- Psychographic profiling: What are their values, interests, lifestyle choices, and priorities?

- Behavioral patterns: How do they make purchasing decisions? What influences their choices?

- Pain point identification: What problems are they trying to solve? What frustrates them about current solutions?

Pro Tip: The Jobs-To-Be-Done Framework

Instead of asking "What do customers want?", ask "What job are customers hiring your product to do?" This subtle shift reveals deeper insights about customer motivations and opens up innovation opportunities.

2. Competitive Analysis

Understanding your competitive landscape helps identify market gaps, differentiation opportunities, and potential threats. A thorough competitive analysis includes:

- Direct competitor mapping: Companies offering similar products/services to the same target market

- Indirect competitor identification: Alternative solutions that solve the same customer problems

- Positioning analysis: How competitors position themselves in the market

- SWOT assessment: Evaluating competitors' strengths, weaknesses, opportunities, and threats

- Pricing strategy comparison: Understanding the market's price sensitivity and value perception

Document your findings in a competitive matrix that allows for easy comparison across key dimensions relevant to your business.

3. Industry and Market Analysis

Looking beyond immediate competitors to understand broader market dynamics helps identify trends and opportunities. Focus on:

- Market size and growth: Current market valuation and projected growth rates

- Industry trends: Emerging technologies, changing regulations, and shifting consumer preferences

- Market segmentation: How the overall market divides into addressable segments

- Barriers to entry: Factors that make it difficult for new entrants to compete

- Economic factors: How broader economic conditions impact your market

4. Product/Service Validation

Before significant investment in development, validate that your offering meets a genuine market need:

- Concept testing: Gathering feedback on product concepts before development

- Prototype evaluation: Testing early versions with potential users

- Beta testing: Limited release to gather real-world usage data

- A/B testing: Comparing different versions to optimize features or messaging

Practical Research Methods for Every Budget

Effective market research doesn't always require expensive agencies or enterprise tools. Here are practical approaches for businesses at every stage:

Low-Cost Research Methods

- Customer interviews: In-depth conversations with current or potential customers

- Online surveys: Using tools like Google Forms, SurveyMonkey, or Typeform

- Social media listening: Monitoring conversations about your industry, competitors, and pain points

- Review analysis: Studying reviews of competitive products for insight into customer needs

- Public data sources: Government databases, industry reports, and academic studies

Example: Effective Customer Interview Questions

When interviewing potential customers, avoid leading questions that confirm your biases. Instead, try these approaches:

- "Walk me through the last time you encountered [problem your product solves]."

- "What solutions have you tried? What worked and what didn't?"

- "How would you describe your ideal solution?"

- "What would make you switch from your current solution?"

- "If you had a magic wand to fix anything about [relevant process], what would you change?"

Mid-Range Research Investments

- Moderated user testing: Observing how users interact with your product

- Focus groups: Facilitated discussions with target customer segments

- Industry database subscriptions: Accessing specialized market data

- Limited-scope research panels: Ongoing feedback from a consistent customer group

Enterprise-Level Research

- Custom market research studies: Tailored research designed for specific business questions

- Ethnographic research: Observing customers in their natural environment

- Conjoint analysis: Determining how customers value different product attributes

- Predictive analytics: Using AI and machine learning to forecast market trends

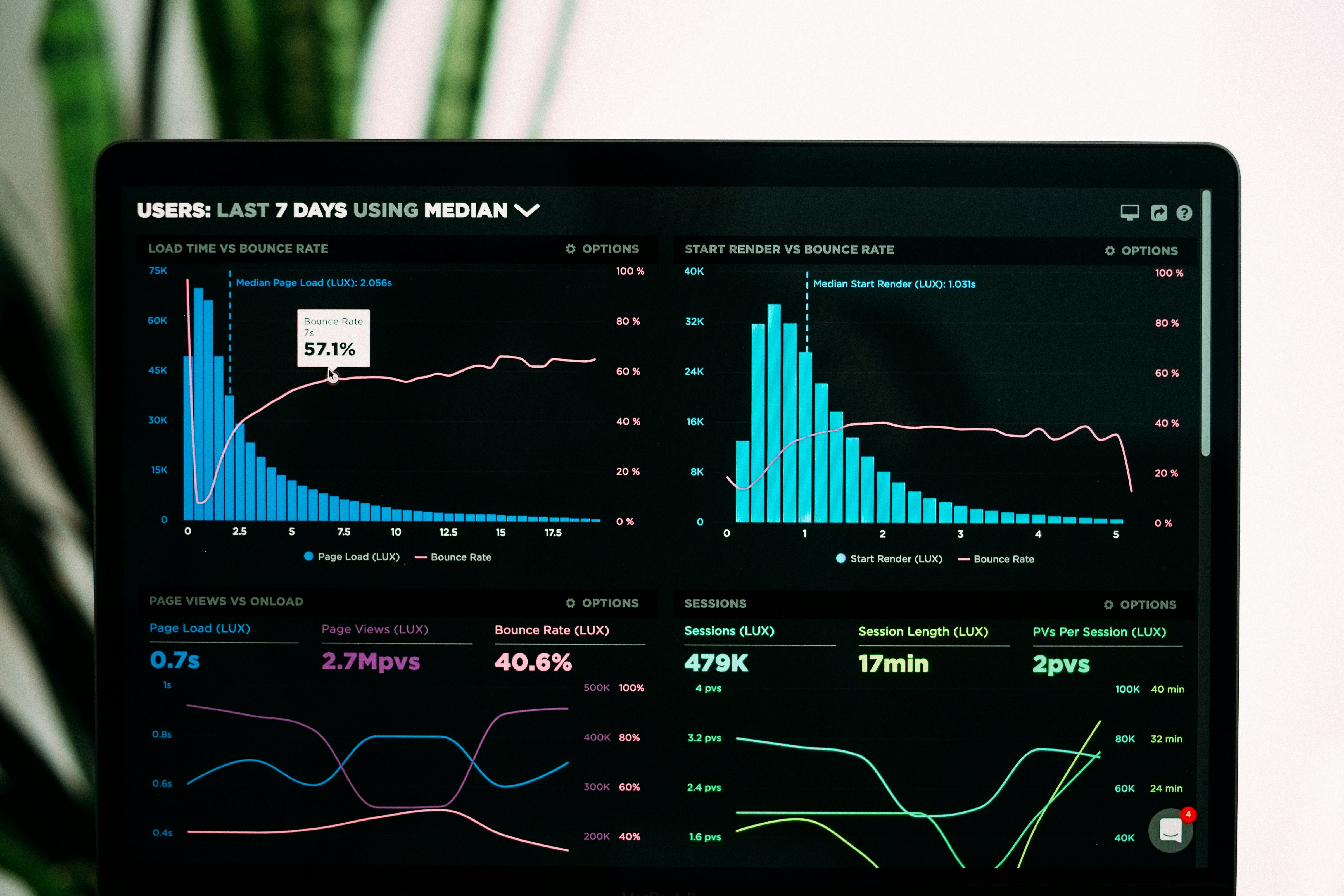

From Data to Actionable Insights

Collecting data is only the first step. The real value comes from transforming that data into actionable insights:

1. Identify Patterns and Trends

Look for recurring themes across different data sources. What consistent patterns emerge from customer interviews, surveys, and market analysis?

2. Challenge Assumptions

Use research to test your business hypotheses. Be willing to pivot when data contradicts your initial assumptions.

3. Segment Your Findings

Different customer segments may have different needs and behaviors. Avoid the trap of treating all customers as a monolithic group.

4. Prioritize Opportunities

Use a framework like the Impact/Effort matrix to prioritize which insights to act on first:

Prioritize high-impact, low-effort opportunities based on your research findings

5. Create Actionable Recommendations

Transform insights into specific action items with clear ownership and timelines.

Case Study: How Proper Research Saved a Startup from Failure

MealMatch, a food tech startup, initially planned to launch an app connecting home chefs with local customers. Their founders were convinced their idea would revolutionize home dining.

Before building their platform, they conducted systematic market research:

- Customer interviews with 50 potential home chefs and 50 potential customers

- Competitive analysis of similar platforms in other markets

- Regulatory research into local food service laws

Their research revealed three critical insights:

- Most home chefs were concerned about liability and regulatory compliance

- Customers were more interested in unique dining experiences than convenience

- Similar platforms struggled with quality consistency and logistics

Based on these insights, MealMatch pivoted to a different model: connecting underutilized commercial kitchens with aspiring chefs to create pop-up dining experiences. This model addressed the regulatory concerns, emphasized unique experiences, and solved the quality control issues.

Within a year, MealMatch was operating in three cities with plans for national expansion—all because they let market research guide their business model rather than proceeding on assumptions alone.

Common Market Research Pitfalls to Avoid

Even well-intentioned research can lead you astray if you fall into these common traps:

Confirmation Bias

Looking only for data that confirms your existing beliefs while ignoring contradictory information.

Sampling Bias

Drawing conclusions from a sample that doesn't accurately represent your target market.

Leading Questions

Phrasing questions in ways that subtly guide respondents toward particular answers.

Analysis Paralysis

Collecting so much data that you become overwhelmed and unable to take action.

Outdated Information

Relying on market research that no longer reflects current conditions.

Pro Tip: Continuous Research

The most successful companies view market research as an ongoing process, not a one-time event. Implement systems to continuously gather customer feedback and monitor market trends.

Conclusion: Research as a Competitive Advantage

In today's data-rich business environment, effective market research isn't just about reducing risk—it's about creating a sustainable competitive advantage. Companies that systematically gather, analyze, and act on market insights make better decisions, develop more compelling products, and ultimately achieve greater success.

Whether you're a startup founder validating a concept or an established business exploring new opportunities, investing in quality market research provides the foundation for confident, customer-centered decision making.

Remember: The goal isn't perfect information (which is impossible), but rather reducing uncertainty enough to make better decisions than your competitors.