In 1944, a small New Hampshire resort hosted a meeting that would reshape global power forever—and most people have never heard the full story. While World War II raged across Europe and the Pacific, 730 delegates from 44 nations gathered at the Mount Washington Hotel in Bretton Woods to redesign the world's financial system. What emerged from those three weeks would create the most powerful currency empire in human history.

Today, when you buy coffee in Tokyo, oil in Saudi Arabia, or gold in London, you're likely using US dollars—even if you're not American. This isn't an accident (everything you know about money might be wrong). It's the result of strategic decisions, historical accidents, and geopolitical maneuvering that transformed a young nation's currency into the world's financial lingua franca (learn how value becomes currency).

The Gold Standard Era: When Britain Ruled Money

Before the dollar's rise, there was another king: the British pound sterling. For over a century, from the 1800s to World War I, Britain's currency dominated global trade through the gold standard system. Countries pegged their currencies to gold, and since Britain had the world's largest gold reserves (chat with Rockefeller about this era) and most powerful navy, the pound became the default international currency.

Historical Context

The phrase "pound sterling" comes from the Norman silver coins called "sterlings" that were so reliable, they became the standard for English currency. This early reputation for stability would define currency dominance for centuries.

But empires rise and fall, and Britain's financial dominance began cracking under the weight of two world wars. The costs of defending democracy were enormous, and by 1945, Britain owed more money than it could realistically repay (calculate your debt freedom). The stage was set for a new monetary superpower.

Bretton Woods 1944: The Meeting That Changed Everything

Picture this: while Allied forces stormed the beaches of Normandy, economists and finance ministers were quietly engineering a financial revolution in the mountains of New Hampshire. The Bretton Woods Conference wasn't just about rebuilding war-torn economies—it was about deciding who would control the world's money.

The 1944 Bretton Woods Conference where 44 nations redesigned the global financial system, establishing the US dollar as the world's reserve currency.

The Americans, led by Treasury official Harry Dexter White, had a bold proposal: make the US dollar the world's reserve currency, backed by gold at $35 per ounce. Other countries would peg their currencies to the dollar, and the dollar would be convertible to gold. It was brilliant in its simplicity—and in its implications.

The British, represented by the famous economist John Maynard Keynes, proposed an alternative: a new international currency called "bancor." But Britain was broke, and America held most of the world's gold. Economic power talks, and in 1944, America was doing all the talking.

The Numbers Don't Lie: By 1945, the United States held approximately 60% of the world's official gold reserves—about 20,000 tons. This gave them unprecedented leverage in designing the new monetary system.

The Nixon Shock: Breaking the Gold Promise

For nearly three decades, the Bretton Woods system worked—until it didn't. By the late 1960s, America was spending heavily on the Vietnam War and President Johnson's Great Society programs. The government was printing more dollars than it had gold to back them, and other countries began to notice.

France's President Charles de Gaulle famously called the arrangement America's "exorbitant privilege"—the ability to print money that the rest of the world had to accept. In 1965, France began converting its dollar reserves back to gold, and other countries followed suit. America's gold reserves were hemorrhaging.

The Weekend That Shook the World

On August 15, 1971, President Richard Nixon made a shocking announcement that would reverberate through financial markets for decades. In a televised address, he declared that the United States would no longer convert dollars to gold at a fixed rate. The gold standard was dead.

President Nixon's August 15, 1971 announcement ending dollar-gold convertibility, known as the "Nixon Shock," fundamentally changed global finance.

Wall Street panicked. European markets crashed. The carefully constructed Bretton Woods system collapsed overnight. But here's the remarkable part: instead of abandoning the dollar, the world doubled down on it. Why? Because there was no viable alternative.

Market Psychology

The Nixon Shock proved a crucial lesson about currency dominance: trust and habit are often more powerful than gold backing. Once a currency becomes the global standard, replacing it requires enormous coordination—something 190+ countries struggle to achieve.

The Petrodollar Deal: Oil as the Ultimate Weapon

With the gold backing gone, the dollar needed a new source of strength. Enter Henry Kissinger and one of the most brilliant geopolitical moves in modern history: the petrodollar system.

In 1973, the Yom Kippur War triggered an oil crisis (why smart companies love crises) that quadrupled petroleum prices. Instead of seeing this as a threat, American policymakers saw an opportunity. If they could convince oil-producing nations to price their oil in dollars and invest their profits in US Treasury bonds, they could create artificial demand for dollars that would dwarf the old gold standard.

The Saudi Deal

The key was Saudi Arabia, the world's largest oil exporter. In 1974, Treasury Secretary William Simon flew to Riyadh with a proposal: Saudi Arabia would price its oil in dollars and invest its oil revenues in US government bonds. In exchange, America would provide military protection and advanced weapons systems.

The Petrodollar in Action: Today, approximately 60% of global oil transactions are conducted in US dollars, creating constant demand for the currency. When China buys oil from Saudi Arabia, both countries need dollars to complete the transaction—even though neither is the United States.

The deal worked beyond anyone's wildest dreams. Every country that wanted to buy oil needed dollars. Every oil-producing nation accumulated dollars. And where did those dollars go? Right back into US Treasury bonds, financing American government spending and keeping interest rates low.

Modern oil trading floors where billions of dollars in petroleum transactions occur daily, maintaining the petrodollar system's global influence.

Modern Challenges: Cracks in the Crown

But empires don't last forever, and the dollar's dominance faces unprecedented challenges in the 21st century. China, now the world's second-largest economy, has been quietly building alternatives to dollar-based systems. The digital yuan, bilateral trade agreements, and the Belt and Road Initiative all aim to reduce dependence on American currency.

The BRICS Alternative

Brazil, Russia, India, China, and South Africa—the BRICS nations—have been developing their own payment systems and discussing a common currency for international trade. Russia's exclusion from SWIFT banking networks after invading Ukraine accelerated these efforts, proving that dollar dominance can be weaponized.

Cryptocurrency presents another challenge. While Bitcoin and other digital currencies haven't replaced the dollar, they've demonstrated that money can exist without government backing—a concept that would have been unthinkable in 1944.

Future Trends

Central Bank Digital Currencies (CBDCs) represent the next frontier in monetary evolution. China's digital yuan pilot programs and the European Central Bank's digital euro research suggest the future of money may be digital—and potentially less dollar-dependent.

What This Means for Your Financial Future

Understanding the dollar's rise to dominance isn't just academic—it has real implications for your financial decisions. The dollar's reserve currency status affects everything from inflation rates to investment returns to the price of your morning coffee.

Investment Implications

Dollar dominance creates unique opportunities and risks:

- Currency Stability: The dollar's reserve status provides relative stability, but also makes it vulnerable to global economic shifts

- Interest Rates: Foreign demand for US Treasury bonds helps keep American interest rates lower than they might otherwise be

- Inflation Protection: Understanding currency dynamics can help you hedge against potential dollar weakness through international investments or commodities

- Global Exposure: Diversifying beyond dollar-denominated assets becomes more important as alternative systems develop

Practical Strategy: Consider allocating 10-20% of your investment portfolio to international assets or commodities that might benefit from dollar weakness. This isn't betting against America—it's acknowledging that monetary systems evolve.

The Long View

History teaches us that monetary systems change, but slowly. The British pound dominated for over a century before giving way to the dollar. Even if the dollar's dominance eventually wanes, the transition will likely take decades, not years.

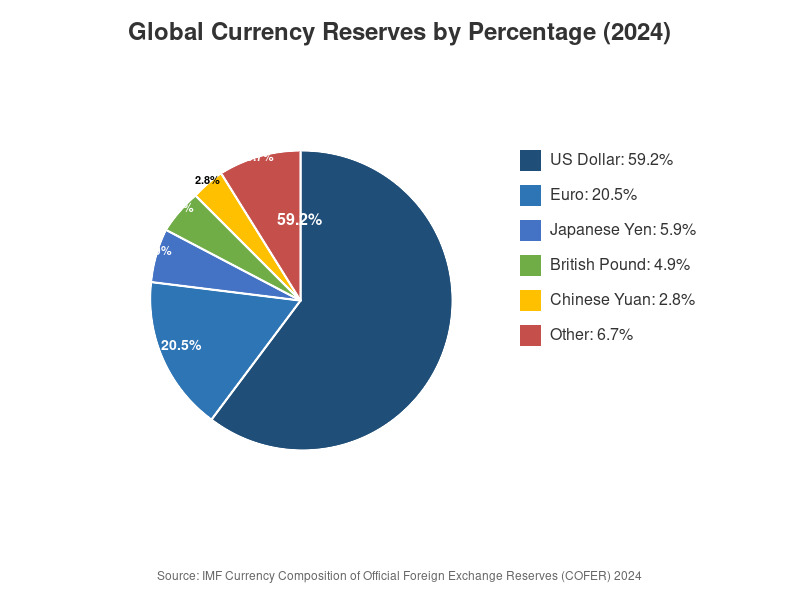

Current global currency reserves showing the US dollar's continued dominance at approximately 60% of world reserves, though this percentage has gradually declined from historical highs.

The key is staying informed and adaptable (get AI coaching on financial strategy). The same geopolitical and economic forces that created dollar dominance continue to shape global finance today. By understanding these patterns, you can make more informed decisions about everything from career choices to investment strategies.

The Crown's Future

The story of how the dollar became king is ultimately a story about power, trust, and adaptation. From the gold-backed stability of Bretton Woods to the oil-backed ingenuity of the petrodollar system, American policymakers consistently found ways to maintain their currency's global relevance.

Today's challenges—from Chinese economic growth to cryptocurrency innovation to climate change affecting oil demand—will test the dollar's resilience once again. History suggests that the most adaptable monetary systems survive, while rigid ones collapse under their own weight.

Key Takeaway

The dollar's dominance wasn't inevitable—it was earned through strategic decisions and maintained through constant adaptation. Understanding this history helps you navigate an uncertain financial future with greater confidence and insight.

Whether the dollar remains king for another generation or gradually shares power with other currencies, one thing is certain: the next chapter in monetary history is being written right now. And unlike the delegates at Bretton Woods, you have the advantage of understanding how the game is played.

The question isn't whether change will come—it's whether you'll be prepared for it when it does.